Methodologies for risk management

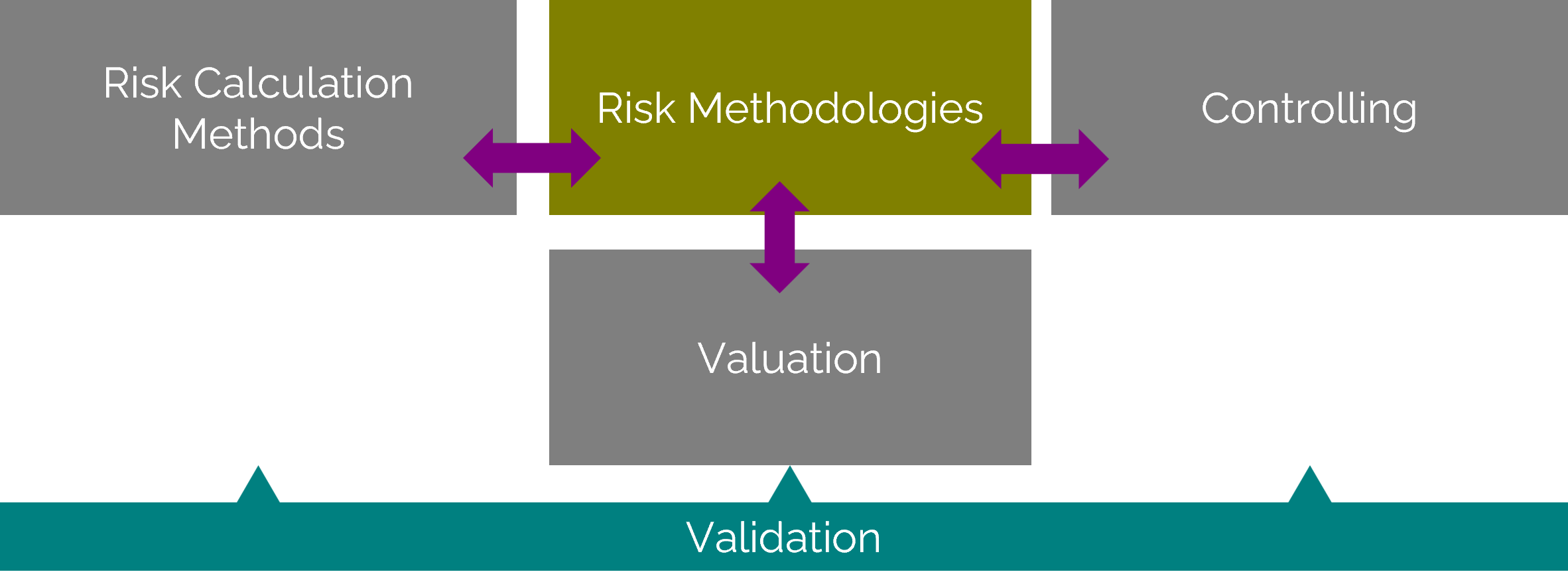

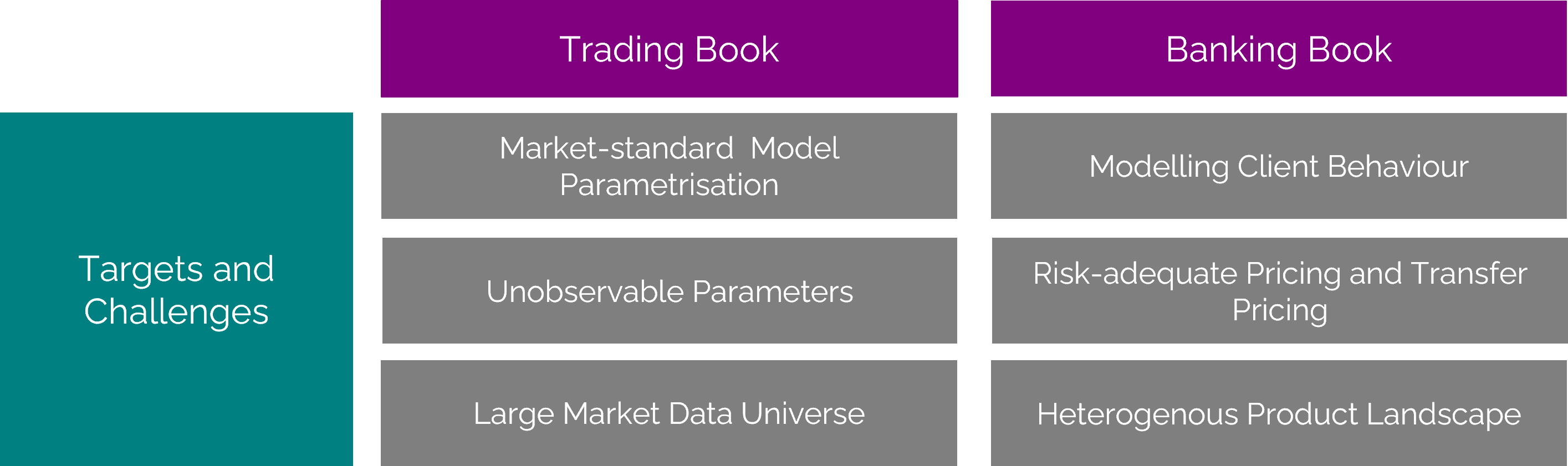

Our approaches are based on a profound understanding of methodologies for risk measurement and risk controlling. Our core expertise is on market and liquidity risk. Internal and regulatory requirements on methodologies for risk measurement and risk controlling are constantly evolving. Some new or amended requirements are, for example,

- Increased regulatory focus on market value-based risk methodologies as a consequence of Germany’s MaRisk (Minimum Requirements for Risk Management) version from 2017,

- More detailed requirements on the modelling of client behavior-driven risk positions for market value and income calculation methods,

- Increased requirements on the governance and validation of models and methods for risk calculation.

We support our clients navigating the demanding current and future economic and regulatory requirements. And we help turning business opportunities into profits.

Model governance and valuation methodologies

Valuation models are at the core of all market value-based and income-based risk methods. Moreover, valuation results feed into the pricing of banking products, internal cost calculations, transfer pricing.

We have extensive expertise and a several years’ successful track record on valuation methodologies and governance processes for valuation and risk models. This expertise is a key competence for modern bank-wide risk management.

We support our clients, for example, on the following topics:

- Valuation methodologies for financial instruments.

- Valuation of money market and fixed income instruments, Vanilla and exotic derivatives.

- Parametrization of valuation models across all asset classes.

- Valuation methodologies for banking book products including loans and deposits with embedded options.

- Valuation methodologies for client behavior-driven option components and call deposits in the context of market and liquidity risk.

- Methodologies for valuation adjustments and reserves for fair value positions.

- Exposure simulation methodologies for counterparty credit risk (CCR) and XVA.

In addition, we support our clients on the management of market data and market data quality. We also cover valuation aspects related to credit and default risk.

Risk systems and risk architectures

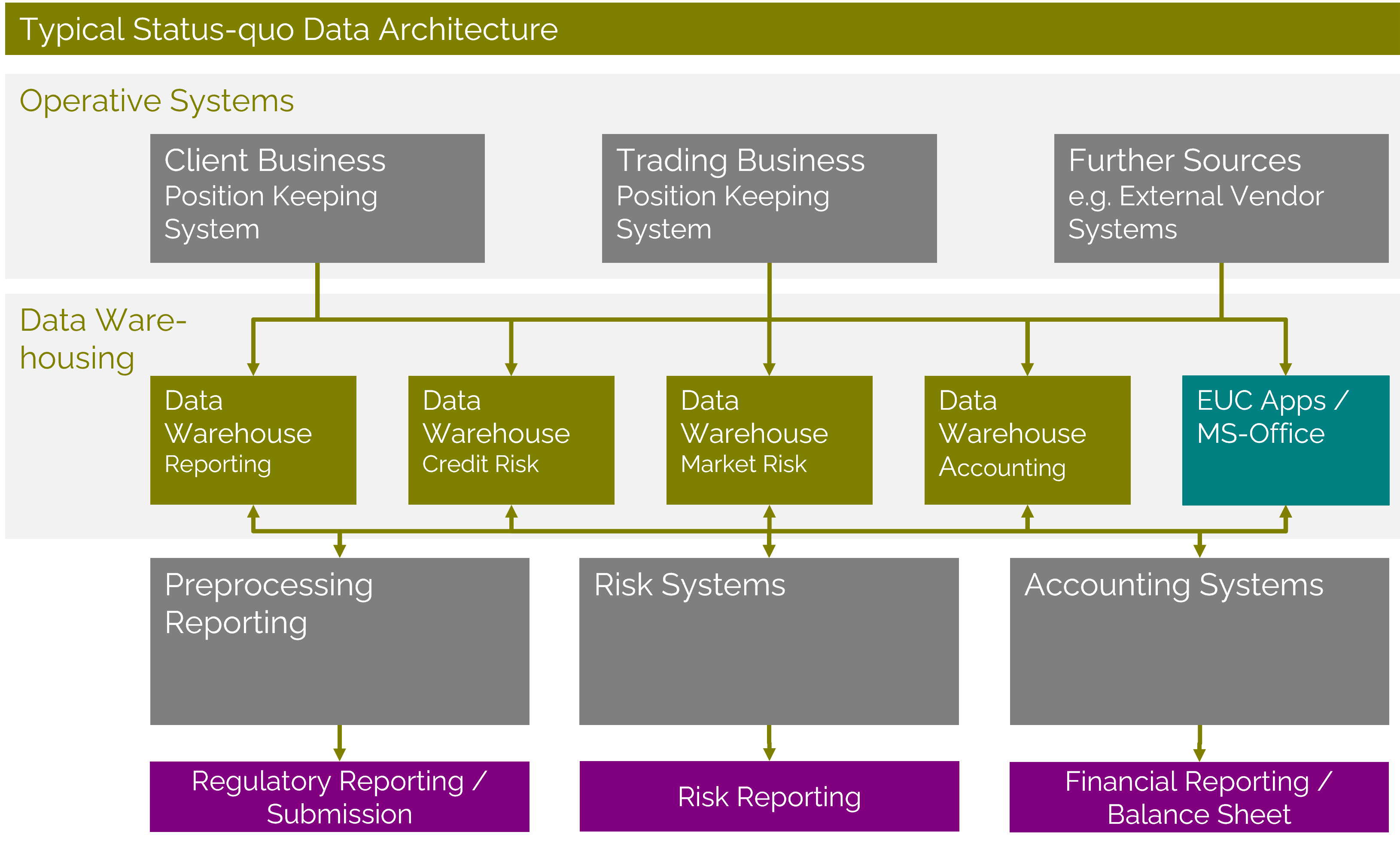

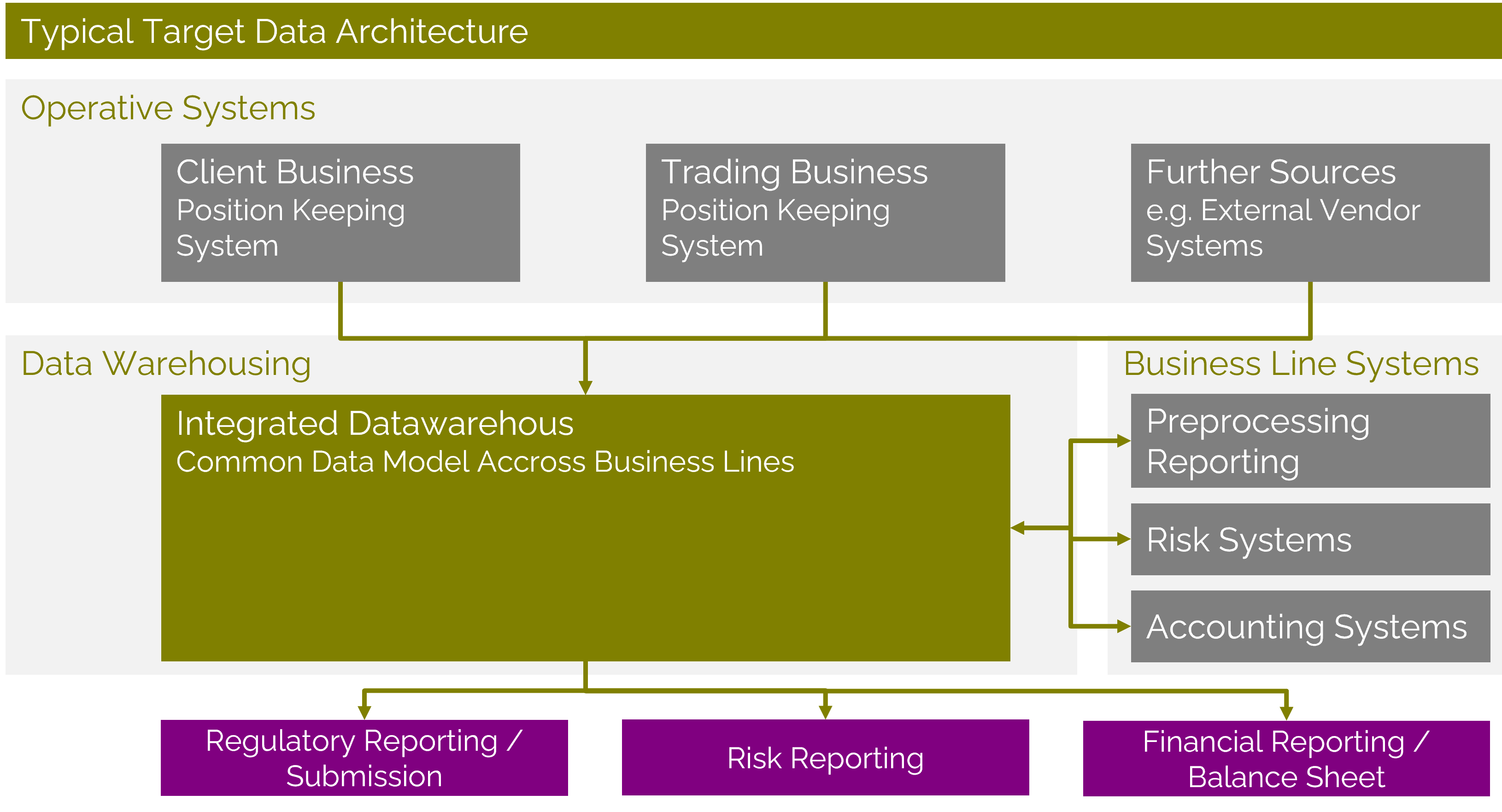

Continuous development and advancement of risk systems and risk architectures is key for the fulfillment of current and future requirements. Digitalization of bank-wide risk management processes offers opportunities for automation, operational risk reduction and improvement of controlling processes.

We have extensive experience in digital transformation and implementation processes. In particular, we support our clients on the following topics:

- Selection of software systems and pre-studies to assess suitability of application and data architectures.

- Development and integration of software systems.

- Reduction of spreadsheet-based or EUC-applications in critical business processes.

- Modernizing and harmonizing market data infrastructures

Data structures in financial institutions are often grown over years and developed in silos. This leads to complex dependencies.

Recent requirements in the context of BCBS 239 are hard to implement in such an IT setting.

Implementation, maintenance and further development of a uniform data warehouse has become an integral task for all banks.

We support our clients in disentangling complex data and application dependencies with our broad expertise across banking processes.

Project management

Change processes in financial institutions often need to be implemented balancing requirements on methodology, control processes and technical infrastructure across business lines. In such situations, project management is of particular importance.

In addition to a suited project management approach, we put particular emphasis on

- Transparency and clarity in communication with all project members and stake holders,

- Showing motivation and enthusiasm while leading the project team,

- Mutual respect and pinch of humor.

With these principles we successfully delivered large-scale and small strongly focused initiatives from planning to go-live.

Newsletter

Stay informed about recent market developments, articles and tools via our newsletter.